Introduction

Cars are literally becoming digital devices on wheels. It’s no longer enough to just drive from point A to point B – drivers and passengers expect the car to entertain them, help with navigation, and understand their preferences. As vehicles become increasingly software-defined, consumers are placing higher demands on in-car digital experiences.

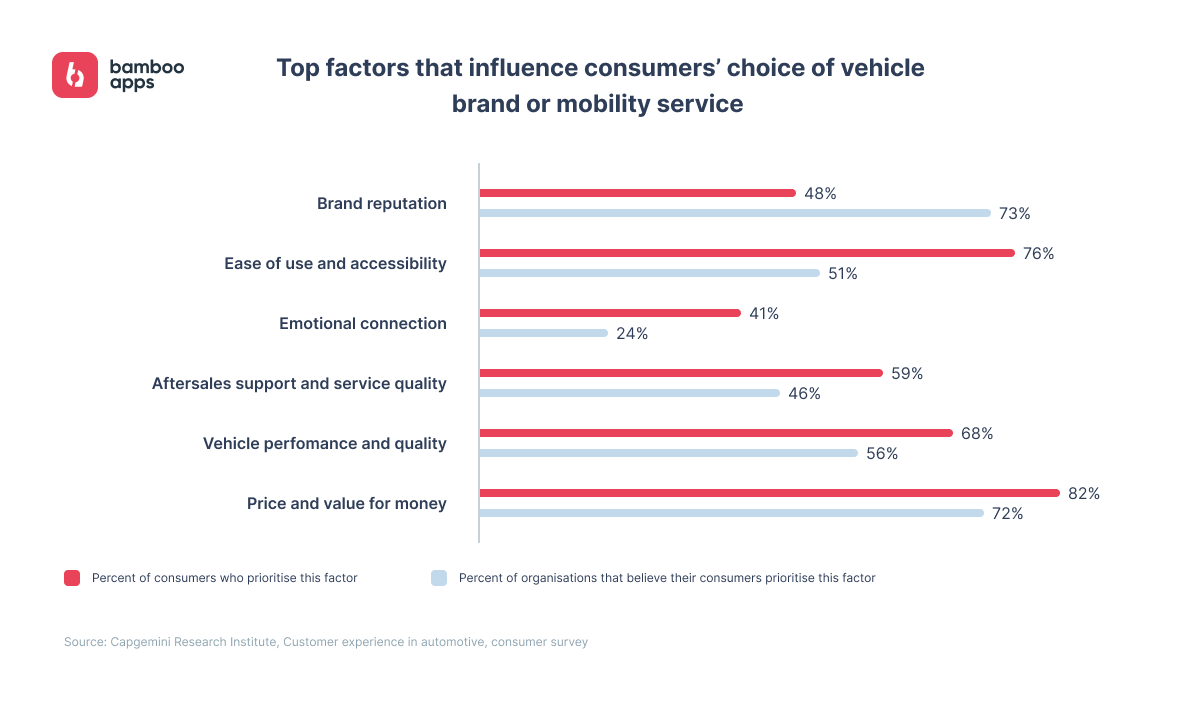

However, the opinions of automobile executives and consumer tastes differ significantly. According to a Capgemini Research Institute study, 73% of CEOs consider brand reputation a major consideration when purchasing a car, while only 48% of buyers cite this as the most important factor.

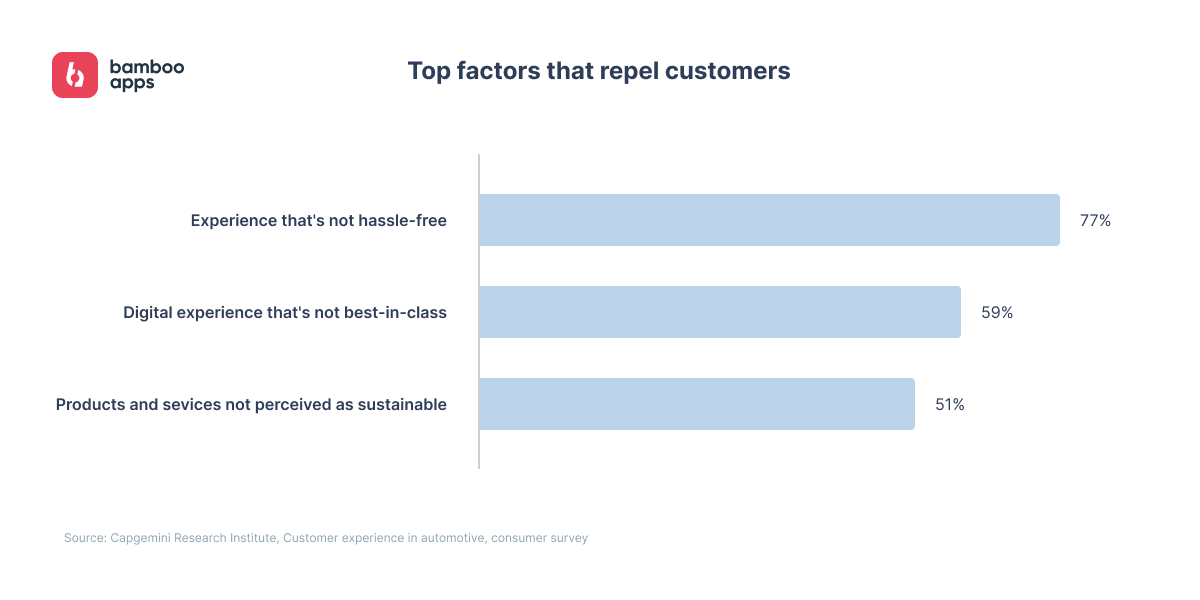

Besides, the same study reveals that 77% of consumers are turned off by experiences that aren’t hassle-free, and 59% are dissatisfied with digital services that fall short of being best-in-class. The message is clear: users are quick to turn away when their expectations aren’t met.

In this regard, Android Automotive OS (AAOS) provides a technological foundation that allows you to flexibly create and deploy new types of in-car applications and services. As a result, there is a wide range of opportunities to adapt to the real needs of users and position user experience as a critical differentiator in the automotive market.

About Android Automotive OS

Android Automotive OS is a modified version of the Android operating system designed specifically to run directly on the car’s head unit. Unlike Android Auto, which projects the phone interface to the vehicle screen, AAOS is an independent platform that manages multimedia, navigation, climate, and other functions directly within the onboard system. It was created by Google and Intel, in partnership with automakers including Volvo and Audi, and debuted in March 2017.

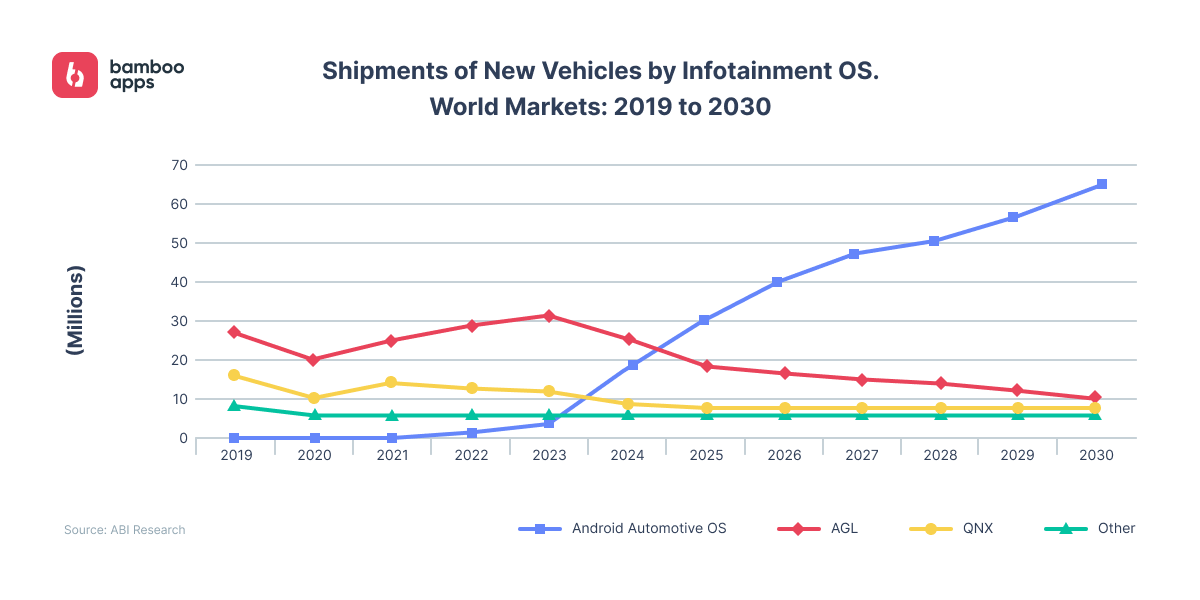

Android Automotive has already become the in-vehicle infotainment system of choice. Since 2020, when the Polestar 2 became the first car to be equipped with Android Automotive, the industry has been keeping an eye on it.

Starting from 2022, AAOS is gaining the upper hand over other infotainment operating systems, predicted to reach more than 60 million shipments by 2030. Nowadays, more than a hundred production models use Android Automotive, including models from Polestar, Volvo, Renault, Chevrolet, Honda, Ford, and BMW. Nissan, Mitsubishi, Stellantis, Honda, Lucid, Porsche, and Hyundai are also interested in adopting AAOS in the near future.

Why Android Automotive matters for the automotive industry

AAOS’s potential is truly revealed when a wide variety of market participants come into play.

For some, it’s an opportunity to keep up. When services like Spotify turn out to be built into the car’s interface out of the box, their direct competitors, even if they hadn’t thought about this segment before, begin to quickly look for ways to get there.

For others, on the contrary, it is a reason to take a step forward. Suppliers like Bosch see AAOS as a tool that can be used to quickly assemble a unique solution to meet the requirements of a particular automaker, whether it’s smart navigation or an adaptive voice assistant.

And there are those who use the system as a strategic element of the brand. For example, Mercedes-Benz doesn’t just integrate Android Automotive – it builds its own digital experience around it, where voice control and climate control merge into a single user scenario.

New in-car services for a competitive edge

As competition between automakers and technology companies intensifies, the ability to offer unique embedded services becomes an important differentiation factor. For example, an opportunity to watch streaming videos, play simple games while charging an electric car, or receive proactive recommendations from AI-based systems allows you to turn cars into a truly ‘smart’ environment.

New user engagement opportunities

Android Automotive OS opens the doors to the automotive segment for companies not previously associated with this industry. Developers of media, messaging, and IoT applications have the opportunity to reach a new audience like drivers and passengers, who increasingly perceive the car as an extension of their digital ecosystem.

When familiar scenarios like listening to music, texting, and navigation adapt to driving, interaction with applications becomes more frequent and prolonged in new contexts: on the road, in the parking lot, while waiting for charging.

In addition, new monetisation models are emerging. The ability to implement in-app purchases directly from the car screen opens up additional revenue for both app developers and automakers. This can include access to premium content (such as paid podcasts or exclusive music selections), microtransactions in games, paid features in navigation services, or integration with subscriptions, such as a subscription to a video service optimised for cars.

Tailored solutions for OEMs

Tier-1s can refine AAOS in accordance with the individual OEM requirements to their infotainment system, starting from the visual design of the interface and ending with deep integration with the vehicle’s equipment and services. They take on the task of customising the platform: redesign the user experience in accordance with brand standards, adjust support for specific hardware components, ensure compatibility with the automaker’s internal systems, and are responsible for meeting industry standards for safety and performance.

Moreover, thanks to the support of the standard Android API and custom extensions, some specific functionalities can be integrated a way faster. Tier-1 vendors can quickly implement or replace components such as voice assistants, navigation, multimedia applications, and connectivity modules.

In fact, this is the level at which the standard version of Android Automotive turns into a unique proprietary system that is recognisable to the driver as part of the ecosystem of a particular brand.

Deep integration with car controls

Android Automotive OS can deeply integrate with vehicle systems: multimedia, climate control, navigation, sensors, and even voice assistants. This creates scope for applications that can adapt to real-world driving conditions and user preferences.

Navigation services can take into account battery charge or fuel level, media players can adjust volume depending on speed, and smart assistants can control the temperature in the cabin. This access to the vehicle’s systems gives developers the tools to create more useful and context-aware solutions. For technology companies and automakers, this opens opportunities to create new digital services embedded not on top of, but within the very logic of the car.

Key app categories built for Android Automotive

One of the main advantages of the AAOS is that it gives you an opportunity to deploy an ecosystem of applications in the car that are familiar to the user on a smartphone, but adapted to the automotive environment. Four key categories are developing especially actively now: media, messaging, navigation, and IoT.

Media apps

Media applications are, in fact, the basic standard. Music, podcasts, audiobooks – everything that the user is used to while being on the road. Spotify, YouTube Music, and Audible have already been adapted to AAOS and allow you to control playback via touch or voice. At the same time, the manufacturer can customise the interface to match the visual style of the brand.

Messaging apps

Messengers are a separate story. It is important for the driver not to be distracted from the road, but at the same time to stay in touch. But integrations with WhatsApp, Telegram, and Google Messages allow messages to be read out by voice, and users can respond via dictation. Everything is built around a hands-free approach.

Navigation apps

In addition to the default Google Maps, alternatives like Waze or Sygic are also supported on Android Automotive. Navigation apps can access vehicle data – for example, the remaining charge in the EV – and can suggest routes based on charging stations or traffic jams in real time.

Internet of Things

IoT applications in the context of Android Automotive are tools that let a car interact with other devices and digital services outside the vehicle. Through applications like SmartThings, the driver can turn on the heating in the apartment from the car, check whether the front door is locked, or open the gate in front of the entrance. All this is done directly from the infotainment screen or by voice control.

Available Android Automotive apps

The Android Automotive OS ecosystem continues to expand, and today 100+ customised applications are already available in cars with Google built-in support. This includes navigation, music, messengers, podcasts, as well as the first examples of games and video services (available for use in parking mode).

In February 2025, Google officially announced that such categories as videos, browsers, and games would be available for download on AAOS vehicles. They are intended to be used while the vehicle is parked. Among such apps are games like Farm Heroes Saga, streaming services like AMC+ and Paramount Plus, as well as a news app from NBC.

In the announcement, Google didn’t roll out a specific list of apps, but a constantly updated list of compatible apps is available on Google Play in a special section dedicated to car-ready apps.

How Android Automotive apps integrate with vehicle systems

One of the key advantages of the Android Automotive OS is the deep native integration of applications with vehicle systems. In contrast to solutions like Android Auto, where the smartphone acts as the main computing center, here, the operating system itself runs on the head unit of the car and interacts with its systems directly.

Integration with infotainment and display systems

Applications can make full use of the central screen (infotainment system), the digital dashboard (gauge cluster), as well as secondary displays for passengers. Android Automotive OS natively supports various control types, including touchscreens, rotary controls, and hardware buttons that are easily configurable through the standard Android input framework.

A special feature of the platform is its support for multi-displays, which allows content to be displayed not only on the central screen, but also on the dashboard, provided the OEM permits it. Only system applications or applications with manufacturer’s permissions can be used to display information in the cluster, which allows users to display navigation prompts, current track data, call and message notifications, and climate control indicators.

At the same time, Android Automotive OS receives real-time data through the Vehicle Hardware Abstraction Layer (Vehicle HAL), including speed, gear position, and driving mode. This way, users dynamically control the display of content, for example, disable video playback at high speed.

The infotainment system and the dashboard work in close synchronization: navigation instructions on the main screen can be duplicated or supplemented on the dashboard, information about the media being played is updated in both places, and the voice assistant responses are displayed where provided by the OEM design.

Integration with other vehicle controls and ADAS

The AAOS provides an API for interacting with vehicle functions, such as climate control, battery level, and lighting settings. This allows you to create customised interfaces and automation like starting seat heating at low outdoor temperatures. AAOS can also interact with ADAS systems: lane keeping assistants, blind spot monitoring, parking, and others. Although direct control of ADAS is not allowed by third-party applications for security reasons, applications can use its data, for example, for contextual notifications, alerts, or real-time route adaptation.

While some functions are fully controllable through the platform, others are limited to read-only access. The tables below outline which systems typically allow full control and which expose data for monitoring only.

| System category | Details |

| Systems with full control | |

| Climate and comfort controls | Apps can adjust HVAC settings, control seat heating/cooling, and respond to environmental conditions (e.g., turn on seat heater when it’s cold). |

| Infotainment controls and inputs | Full access to physical buttons, rotary knobs, touchscreen input, and voice commands for controlling media, navigation, and UI. |

| ADAS-driven UI adaptation | UI elements (like visual cues, overlays, warnings) can adapt based on ADAS data, such as lane keeping status or parking proximity.

Note: Data is read-only, but UI behavior is fully controllable. |

| Systems with read-only access | |

| Driving status & gear info | Applications can read real-time speed, gear position, ignition state, and parking brake status, but cannot influence them. |

| Lighting & visibility management | Typically limited to reading the status of headlights, indicators, or wipers. Some OEMs may allow limited control. |

| Door & access control | Mostly limited to status monitoring of doors and locks. Some OEMs expose lock/unlock functionality under specific conditions. |

| ADAS alerts and status | Read-only access to system warnings and statuses such as lane departure, blind spot alerts, and automatic parking indicators. |

Integration with sensors

Applications can access information from vehicle sensors: GPS, acceleration sensors, tire pressure, ambient temperature, and others. This expands the possibilities for creating context-sensitive functions, such as weather tips or driving style recommendations.

However, as with other subsystems, access levels vary depending on the type of sensor and OEM restrictions.

| Sensor category | Access and usage in AAOS |

| Motion and positioning sensors | Full read-only access to GPS, accelerometer, gyroscope, magnetometer, barometer, IMU, ambient light, proximity, and temperature sensors. Used for motion tracking, driving analysis, and context-aware features. |

| Environmental sensors for climate | Temperature sensors provide read-only data, but applications can respond by adjusting HVAC settings, enabling climate automation based on sensor input. |

| Perception sensors (radars, lidars, cameras) | No direct access to raw data. Processed information or alerts may be available, depending on OEM policy. Used mainly for safety and contextual awareness. |

| Camera feeds integration | Read-only access to live camera streams for display purposes (e.g., reverse or surround view). No control over camera hardware or image capture. |

| Driver monitoring systems | Applications may receive high-level alerts (e.g., drowsiness or distraction warnings), but do not access raw video or control the monitoring system directly. |

Access to other vehicle data streams

Through the Vehicle Properties API, applications can read vehicle states, such as whether the doors are open, whether the headlights are on, and what mode the transmission is in. This is useful for building smarter interaction scenarios, such as blocking distracting content on the screen when moving.

Internet access and cloud services

Since Android Automotive OS works independently of a smartphone, it can use the car’s built-in cellular modem or Wi-Fi module to connect to the Internet. This allows applications to work with cloud services, synchronise profiles, receive OTA updates, and send telemetry.

Artificial Intelligence in Android Automotive

Artificial intelligence is becoming a key element in the transformation of the automotive interface. The latest IBM’s “Automotive 2035” study reports that 74% of executives surveyed believe that by 2035 vehicles will be software-defined and AI-powered.

AI-powered personalisation

Many automakers, including Volvo and Polestar, are already using Android Automotive with the ability to recognise a specific driver. For example, the system can, without a single command, activate the night mode on the display, suggest the desired playlist on Spotify, and turn on the seat heating if the temperature outside is below zero.

Context-aware suggestions

Depending on the situation, the driver can receive cues in a variety of circumstances. Google Assistant in Android Automotive can remind you to check out earlier than usual if traffic is forecast along the usual route. Or, knowing that you drive out of town on Fridays, it can suggest setting a route in advance, taking into account traffic jams and stops for charging an electric car.

Voice recognition and natural language processing (NLP)

AAOS allows integration with Google Assistant or alternative OEM voice assistants. Thanks to this, users can execute commands in a natural way. You can say “Show the nearest gas stations” or “Turn on soothing music” and get an instant response.

NLP systems are also used for personalisation: the assistant can take into account the context like time of day, location, preferences of the driver, and provide more relevant answers.

Object recognition

Although Android Automotive itself does not perform object recognition or manage autopilot or cameras directly, it can visualise and display data received from external systems. For example, if the ADAS detects pedestrians or cyclists nearby, Android Automotive can show warnings or alerts on the vehicle’s interface.

Navigating the challenges of Android Automotive app development

The development of applications for Android Automotive OS opens up new horizons, but it is also accompanied by a number of technical and organisational difficulties, especially when compared with the Android mobile ecosystem.

Compatibility across car models

Manufacturers adapt AAOS to specific models by adding or removing functions. As a result, the same application may run differently on different vehicles. It is important for developers to test their applications in emulators and on real devices from different manufacturers using Vehicle HAL (Hardware Abstraction Layer) and Google templates.

Customisability

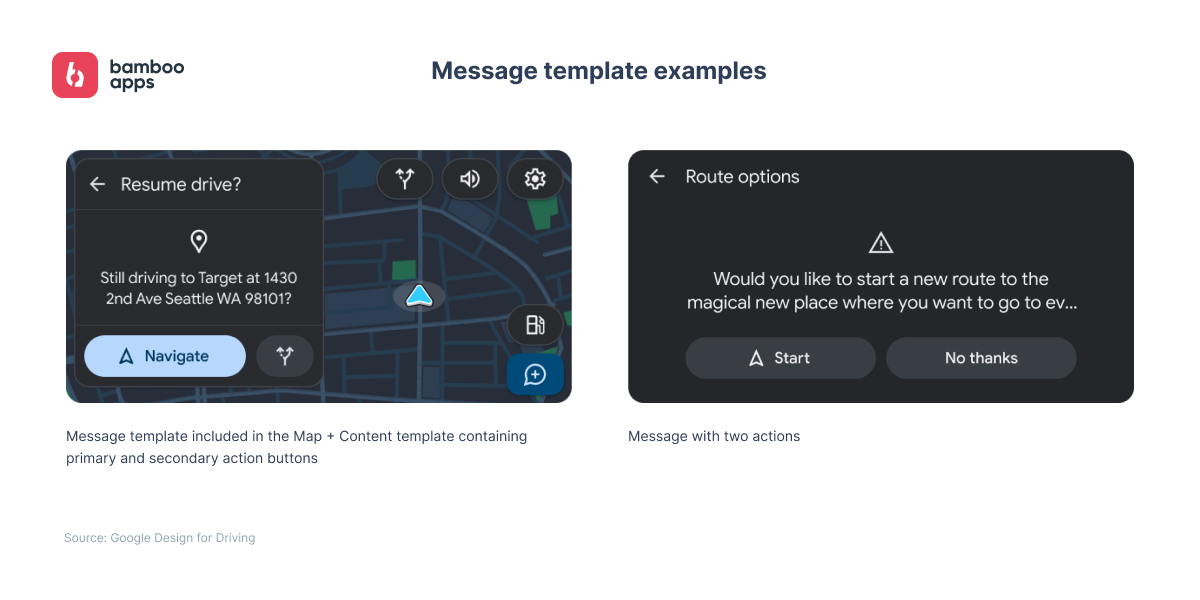

The AAOS imposes restrictions on UI/UX design, especially for security-related applications (such as navigation or messaging apps). The interface must match the templates of Material Design for Cars, otherwise Google will not allow it to be published. Therefore, it is impossible to simply ‘migrate’ a mobile application. It’d be required to adapt screens, simplify logic, and work with the CarApp or Jetpack for Cars frameworks.

Safety and compliance standards

Since we are talking about software inside a moving vehicle, the requirements for stability and fault tolerance are higher than those for conventional mobile applications. AAOS applications must be checked for compliance with the Android Compatibility Test Suite (CTS) and Car Quality Guidelines, especially if they relate to media, communications, or navigation. Google also restricts the use of WebView in browser applications and prohibits third-party video streaming solutions if they may distract the driver.

Over-the-Air updates

Many OEMs implement OTA updates for the system and applications, which adds flexibility but also complicates the work of developers. Applications must be resistant to different firmware versions, able to work offline, and updates should not require driver intervention, this is the rule of UI-less updates.

Data privacy concerns

The AAOS provides access to vehicle data, but strictly regulates its use. For example, access to data on speed, location, battery charge, or driving modes must be justified and authorised by the user. The Vehicle Data API can only be used within permitted application types (e.g. EV charging or navigation). But McKinsey’s survey shows that only fewer than 20 percent of all car owners are willing to share their data.

Looking ahead: the future of Android Automotive

Android Automotive is positioned as the future cornerstone of connected car technology and in-vehicle infotainment. Most major car manufacturers have adopted or announced plans to adopt AAOS, with only a few exceptions like Tesla and Mercedes, which use Linux-based platforms but may integrate Android apps as third-party services.

We asked Maxim Leykin, Chief Technology Officer at Bamboo Apps, whether he believed Android Automotive would serve as a driving force or just one of many competing platforms in the next 3–5 years.

Maxim Leykin, CTO at Bamboo Apps

“I don’t see much of a contradiction in the question. The specifics of the automotive industry and the market is that they are highly fragmented and extremely competitive, thus, the same goes for in-vehicle software. So, I don’t think there will be one and only software platform solely adopted by the industry.

At the same time, I’m sure that Android Automotive, already adopted by many major automakers like Ford, General Motors, Honda, Nissan, Renault, Volvo, Polestar and more, has the strong potential to be a significant driving force in the software-defined vehicle landscape over the next 3–5 years. The reasons are: its deep integration with vehicle functions, openness for customisation via AOSP, access to the Google ecosystem (Maps, Assistant, Play Store), and support from a large global developer community”.

According to predictions, Android Automotive is set to grow rapidly in the coming years. The next few years might be crucial for Android Automotive’s expansion, and it is expected to capture around 18% of the market share by 2027. And around 80% of Volvo’s cars are forecast to have the system by then.

Partner with us for Android Automotive app development

When it comes to developing Android Automotive OS apps, Bamboo Apps is your trustworthy partner. Our team has successfully collaborated with leading companies in the sector such as Jaguar Land Rover, Mitsubishi Electric, Škoda Auto, Rinspeed, and Gentherm. We have 10+ years of experience in creating user-friendly automotive media and connectivity apps that integrate with modern in-car systems.

Let’s talk about building your next AAOS app – contact us to start planning.

FAQ

What is the difference between Android Auto and Android Automotive OS?

Android Auto is a projection system in which your mobile device is connected to the car and its interface is displayed on the car screen. Android Automotive is a separate operating system installed in the car itself, running independently of the phone.

What types of apps are available for Android Automotive?

As of 2025, media, navigation, messaging, and IoT apps, as well as (in extended format) videos, browsers, and games are supported, provided they meet driving safety requirements.

How can developers get started with developing apps for Android Automotive?

Google provides SDKs, emulators, and documentation for adapting Android applications to AAOS. There are also specialised guidelines for each type of application (media, navigation, etc.).

What are the benefits of integrating Google services into Android Automotive?

With Google Automotive Services, developers gain access to Google Assistant, Google Maps, the Play Store, and other services, simplifying the user experience and expanding monetisation opportunities. However, working with GAS requires separate certification and partnership with Google.